GLOBAL & EUROPEAN MONEY WEEK

21. - 27. March 2022.

RESEARCH:

https://forms.office.com/Pages/ResponsePage.aspx?id=FvJamzTGgEurAgyaPQKQkSw5AZ5gzVROjVnSgAIddVxUNVBYNkFGVTNGSldBRkpQRVA0WUQyTUFLMy4u

Activity from Novska, Croatia:

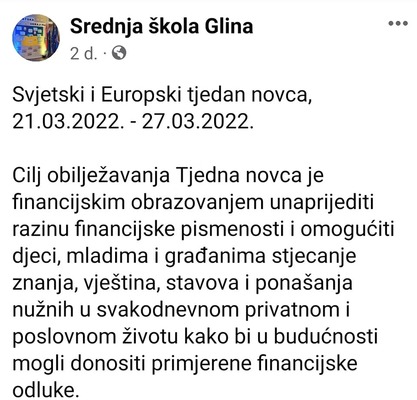

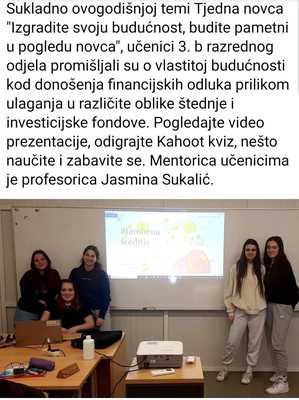

Activity from Glina, Croatia:

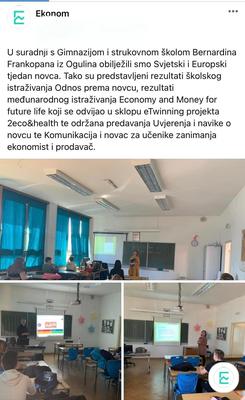

Activity from Ogulin, Croatia:

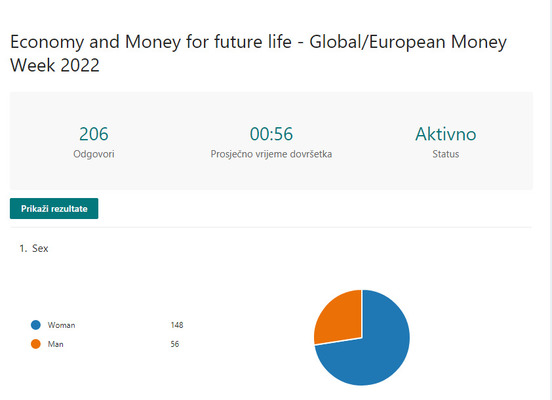

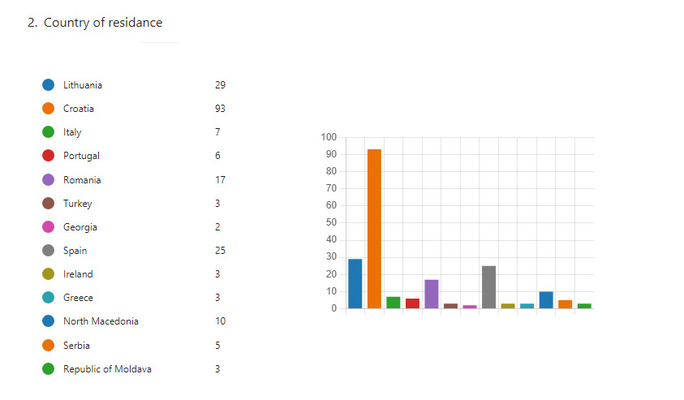

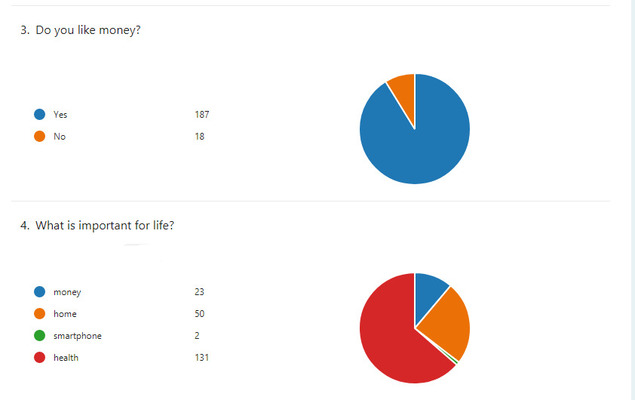

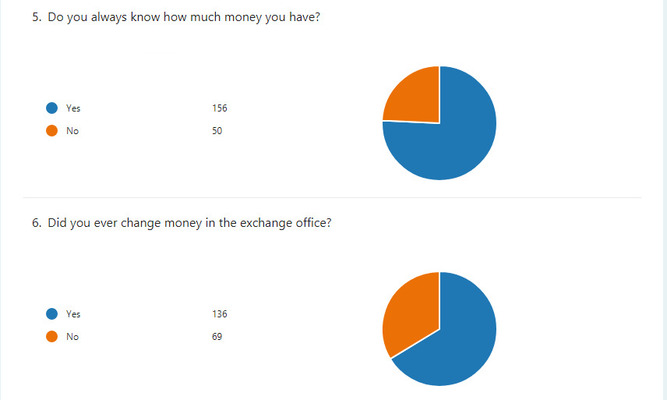

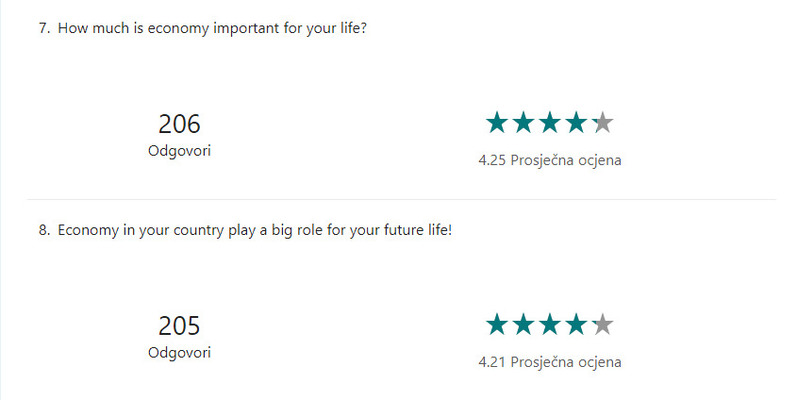

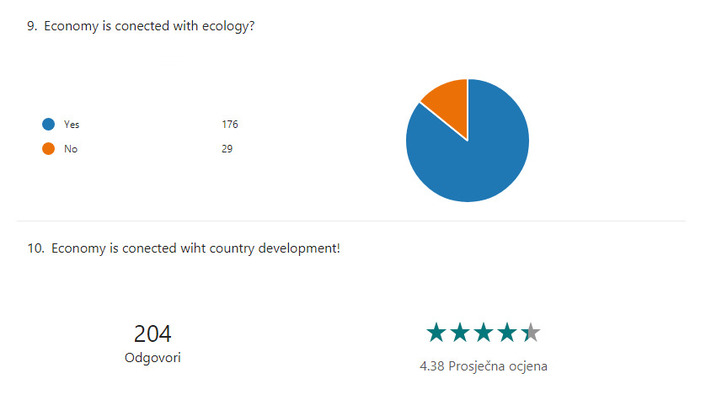

RESEARCH - results:

GLOBAL MONEY WEEK & EUROPEAN MONEY WEEK - research eBook

GMW i EMW - research eBook.pdf